If you rely on invoices to bill for your products or services, you’re probably familiar with this scenario: end-of-the-month crickets when the payments should be rolling in.

You’ve tried automated reminders, friendly-but-firm phone calls, and late fees, but it never fails—there are always a few payments you’re stuck chasing down at month’s end. A strategy that works? Convenience.

A QR Code payment option removes friction and enables customers to pay with a scan and a few taps. Read on to learn how QR Codes for invoicing can streamline your billing process for more on-time payments and better cash flow.

Note: The brands and examples discussed below were found during our online research for this article.

How QR Codes can simplify digital payments

You’ve likely used Quick Response Codes to access menus, get into an event or venue, or even board your flight. But these two-dimensional barcodes have also become a versatile tool for digital transactions and contactless payments, and including them on your invoicing statements makes it simple for customers to pay electronically.

Instead of typing in a long web address, logging into a portal, or navigating multiple screens, customers can simply scan the QR Code on their invoice with a smartphone camera and go straight to a secure online payment portal.

Here, the customer will find all payment details, such as the invoice number, customer ID, and amount due. This minimizes errors (like mistyped account numbers), reduces friction, and accelerates the time it takes to complete a transaction.

For businesses, this creates a more streamlined payment flow, reducing the chances of abandoned payments and easing backend reconciliation by ensuring each transaction is automatically tied to the correct invoice.

Who can use QR Codes for invoicing and payments?

QR Codes for invoicing—and even in-store payments—are becoming increasingly popular worldwide. In some regions, QR Codes are now a requirement for e-invoicing.

The Ministry of Revenues in Ethiopia mandated that all tax invoices include a unique QR Code provided by the tax authority. The initiative aims to improve tax compliance and transparency while streamlining the invoicing process.

Across the globe, businesses in various industries are turning to QR Codes for more secure payments and boosted efficiency, including:

- Professional services: Companies like marketing agencies, consultancies, and law firms can easily integrate QR Codes into their invoices, making it simpler for clients to pay for services rendered.

- Service providers: For electricians, landscapers, plumbers, and other home service providers, QR Codes provide a fast and secure way to accept payments on the job from nearly any mobile device.

- Medical providers: Doctors, dentists, and healthcare facilities can use QR Codes to enable patients to settle their bills directly from their mobile devices.

- Manufacturers: Companies in the manufacturing industry can streamline payments for bulk orders or recurring supplies, enhancing cash flow and customer satisfaction.

How to use QR Codes on billing and invoicing statements

Ready to take your invoicing to the next level? Let’s break down how to create, customize, and optimize QR Codes for seamless payments, ensuring your customers can pay quickly and confidently.

Generate a QR Code

The first step is generating a Dynamic QR Code, which offers more flexibility than a Static Code. A Dynamic Code’s destination can be edited at any time, even after printing. So, if you want to switch to a different payment portal, you can make the change without having to generate a new code.

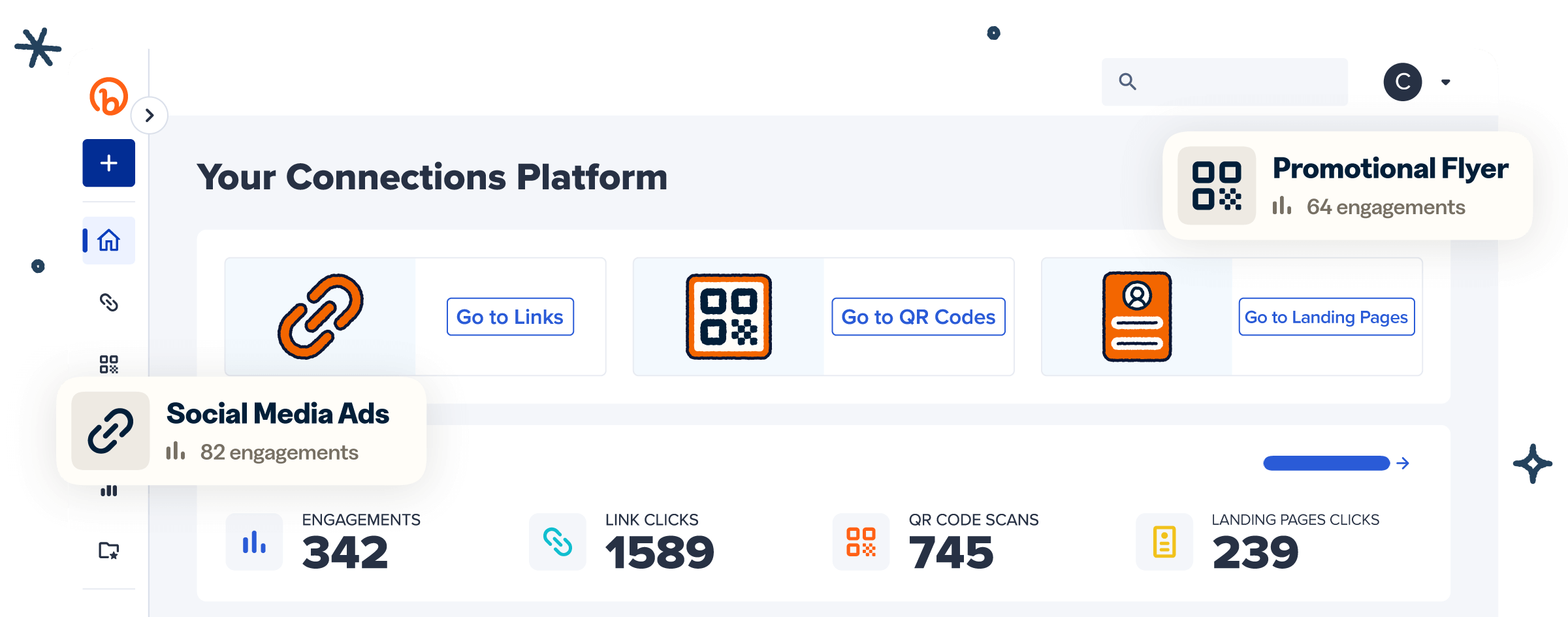

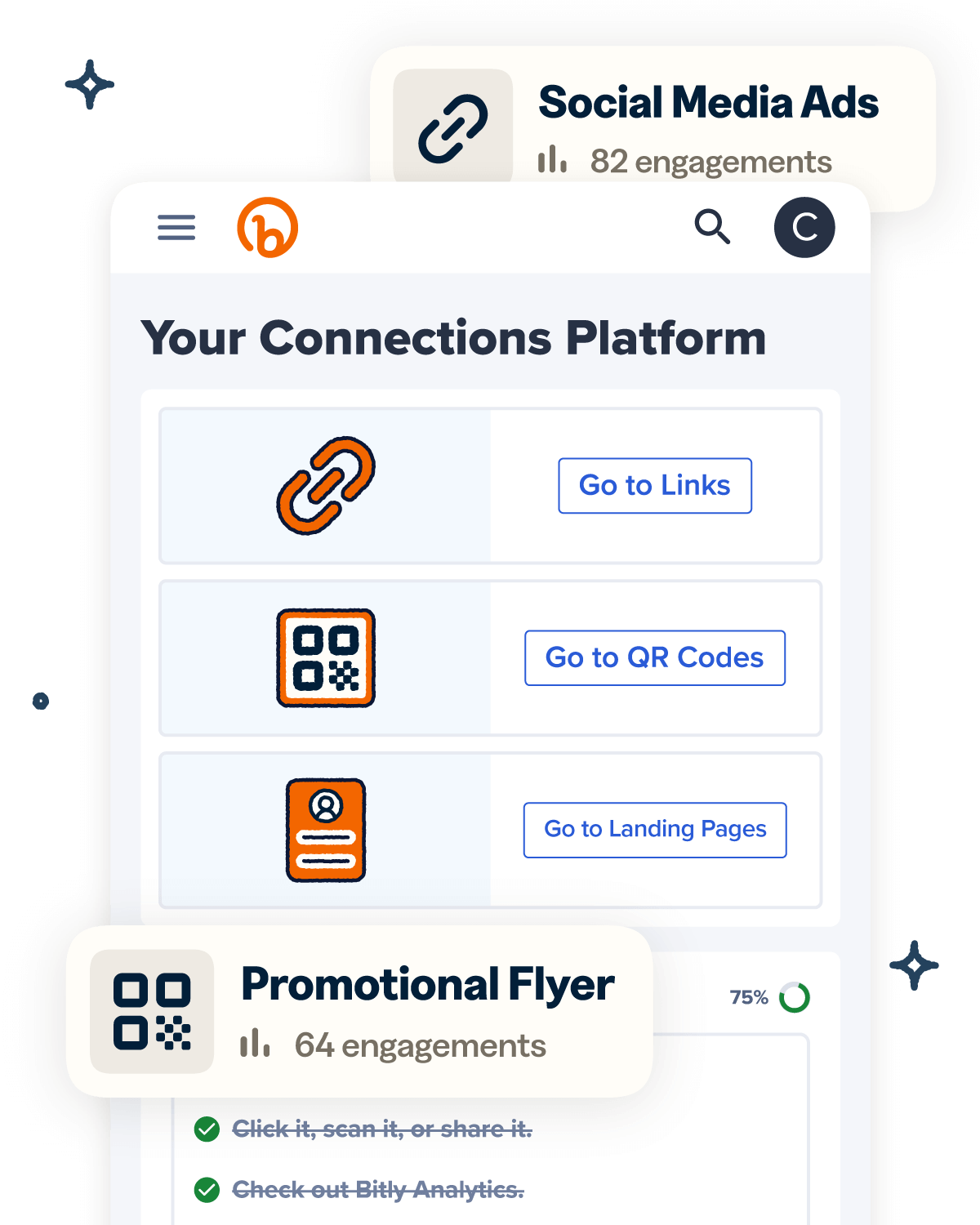

Bitly makes it simple to generate Dynamic QR Codes for payment, and you can even customize your codes with your branding elements. Plus, Bitly tracks scan data and organizes it in a convenient, user-friendly dashboard, helping you measure the effectiveness of your invoicing process.

To generate QR Codes with Bitly, follow these simple steps:

- Sign in to your Bitly account or create a new one.

- Navigate to Create new in the upper left corner of your dashboard.

- Select Create a QR Code.

- Enter your destination URL, add a descriptive title, and customize the short link that will be created along with your Bitly Code.

- Select Design your QR Code. You can add a logo, choose a frame, use your brand colors, and more (depending on your plan).

- Select Create your code.

- Select Copy code or hit the Download button to download your QR Code as a JPG, PNG, or SVG file.

Streamline your invoicing and customer payments with Bitly’s Dynamic QR Codes!

Customize your QR Code

Customizing your QR Code keeps it in alignment with your brand identity, giving your invoices a cohesive and professional look.

Add your logo, brand colors, and a unique frame to make the QR Code stand out and ensure your customers instantly recognize it. Keep contrast in mind for visibility and easy scanning—use a dark QR Code on a light-colored background or vice-versa.

With Bitly, you can also add a call-to-action (CTA) to your code, like “Scan to Pay,” which provides additional guidance for customers. This simple instruction can direct their attention to the QR Code, let them know what to expect from scanning, and prompt them to act.

Ensure the QR Code is visible and easy to scan

Once you’re happy with the appearance, copy or download your QR Code and place it in a clear, prominent location on your invoice.

Make sure it stands out and doesn’t obstruct essential information like the amount due, due date, or invoice number. An upper corner or footer placement often works well, making the code noticeable without crowding key details.

Also, ensure it’s large enough to scan easily—the recommended minimum QR Code size is at least 2 cm x 2 cm (0.8 in x 0.8 in).

Before finalizing the invoice, always test the QR Code using both Android and iOS devices to confirm that it goes to the correct payment portal and works as expected.

Testing ensures everything runs smoothly, so your customers have a seamless experience when they scan and pay.

These simple steps help ensure your QR Code is functional, accessible, and seamlessly integrated into the invoice, streamlining the payment process and enhancing customer satisfaction.

Benefits of using QR Codes for invoicing

According to Juniper Research, QR Code payments are projected to reach $5.4 trillion this year and exceed $8 trillion by 2029. This growing adoption is fueled by the powerful benefits that QR Codes offer when it comes to:

Streamlining the payment process

Ensure your clients can easily make payments by including a QR Code on the invoice. Instead of typing in a long URL or searching for a payment link, they can simply scan the QR Code using their mobile device.

Within seconds, they’re redirected to a secure payment portal where they can complete the payment with just a few taps. This optimized process removes unnecessary steps, making it easier for customers to pay quickly.

Businesses benefit from this streamlined experience by reducing payment friction and increasing the likelihood of on-time payments. When customers can easily make payments, it reduces the risk of payment delays.

In turn, businesses see stronger cash flow, improving their financial position, and letting them focus on growth instead of chasing down payments.

Improving the customer experience

By making the payment process easier and more convenient, QR Codes also enhance the customer experience. Customers can complete payments from anywhere—at home, at the office, or even on the go—making the experience much more flexible.

QR Codes can also connect customers to a wider range of payment methods than just debit and credit cards. Depending on your payment portal setup, you could offer payments through PayPal, Venmo, or even mobile wallets like Apple Pay and Google Pay. This flexibility lets clients choose the most convenient option, creating a smoother, more personalized payment experience.

Get paid on time with QR Codes on invoices and billing statements

QR Codes make payments faster, easier, and more reliable. With a quick scan, customers can pay instantly from their mobile devices, boosting cash flow and reducing delays.

To make the most of QR Codes, you’ll need a solution that not only creates scannable links but also gives you control and visibility. As a leading QR Code generation solution, Bitly offers flexible, customizable Dynamic Codes along with powerful analytics to help you track how your payment process performs.

With Bitly, you can boost confidence and adoption by customizing your codes with your logo, brand colors, and a CTA, update your code’s destination at any time, and monitor real-time scan activity—all from one user-friendly platform.

Streamline your invoicing and reduce late payments with QR Codes—sign up for Bitly today!