Not every sale happens in a store with Wi-Fi, a traditional point-of-sale (POS) system, or a card reader on hand. Sellers like food trucks, farmers market vendors, and field service teams know that offline transactions are just part of doing business. But that doesn’t mean the payment experience has to feel clunky or outdated.

With a QR Code payment solution, sellers can offer a fast, secure digital payment experience—no extra hardware or internet connection required on their end. Just link a QR Code to your payment processing page, print it once, and let customers handle the rest from their smartphones.

As long as buyers have cell service or Wi-Fi, they can scan and pay, giving you a simple, professional way to collect payments offline.

Note: The brands and examples discussed below were found during our online research for this article.

How QR Codes enable offline sellers to accept digital payments

For sellers without a traditional internet connection or POS system, QR Codes offer a flexible, low-tech way to accept digital payments. And as it turns out, while 57% of small business owners use POS technology, there are still many operating without it. This makes versatile payment tools like QR Codes even more valuable.

And adoption is only accelerating. The QR Code payments market was valued at $11.8 billion in 2023 and is expected to reach $45.9 billion by 2032. Proof that customers are more comfortable than ever paying with a quick scan.

Buyers scan QR Codes to pay digitally

Here’s how a typical QR Code payment works in an offline setting.

When a customer is ready for checkout, they use their smartphone camera to scan a custom QR Code displayed in your store, booth, or on printed signage. From there, they’re instantly taken to a secure payment page via URL.

This page, set up with links from payment providers like Stripe or Square, allows customers to enter their payment information directly from their phones. Once they complete the form, the transaction is processed using their cellular connection.

Sellers only need to print the QR Code once

When you use QR Code payments, there’s no need for an ongoing Wi-Fi connection or a complex technical setup. This makes QR Codes an ideal solution for temporary locations like farmers’ markets, street fairs, or any low-tech environment where plug-in hardware isn’t realistic.

With Bitly Codes, you can print your code once and display it whenever you’re ready to accept payments. Because Bitly Codes are Dynamic, you can change the linked URL anytime, whether you’re switching payment systems or updating the checkout experience. No reprints needed.

This makes it easy to reuse the same code across different days, events, or retail locations while keeping your payment experience smooth and flexible.

Buyers can purchase even in remote or rural areas

One of the most valuable use cases for offline payments is supporting retail stores in areas with limited internet infrastructure. In some rural locations, businesses might have cell phone service but not reliable Wi-Fi, creating challenges for accepting payments.

In fact, the FCC estimates that 8.3 million businesses and households in the U.S. still don’t have access to high-speed internet.

With QR Codes, all the customer needs is a smartphone with cell service—the seller doesn’t need a connection at all. This makes QR Codes a smart payment option for rural retailers looking to avoid costly internet bills while still offering a professional digital payment experience.

Examples of who benefits the most from QR Code-powered offline selling

QR Codes make it easy for many types of businesses to offer digital payment options, even without a traditional internet connection or point-of-sale system. Here are some of the most common use cases for QR-powered offline payments.

Mobile vendors and pop-up shops

Many small businesses don’t have permanent brick-and-mortar locations. Instead, they sell their products in person at pop-up events, local markets, or festivals.

At outdoor events, access to Wi-Fi or electricity isn’t always guaranteed. In this case, using a QR Code is more efficient. Customers can scan and pay using their cell phone service, allowing vendors to process payments without needing complex technical setups.

This approach also works well for food trucks, roadside stands, and other mobile vendors. These scannable links let small businesses focus on selling where they’ll generate the most revenue, not just where there’s internet access.

Service providers and delivery teams

Many service providers work on the go rather than in a single location. Field technicians, mobile cleaners, and delivery drivers often need to accept payment while working directly in their customers’ homes or out in the field.

Some providers carry mobile payment processing tools, but these can be complicated to operate, cumbersome to lug around, and often require a stable Wi-Fi connection. Using QR Codes for instant payments offers a simpler alternative. Customers can scan the code with their smartphone, enter their payment details, and complete the transaction in seconds.

QR Codes also support contactless payments—no need to handle cash, credit cards, or share devices during checkout.

Utilities, donations, and recurrent billers

Organizations that send invoices or paper statements can use QR Codes to direct customers to a digital payment page. Instead of mailing a check or calling to pay, they can simply scan the code as soon as they receive their bill. This makes payments faster and easier, encouraging customers to pay right away instead of waiting until the last minute.

Utility companies and healthcare providers often use this approach on printed statements. It’s also highly effective for nonprofits soliciting donations. By adding a QR Code to your direct mail, you can link donors to a payment portal, streamlining the giving process and creating a better experience for supporters.

Why Bitly Codes are ideal for offline selling

Bitly makes it easy to create professional QR Codes that support your offline selling efforts. Here’s why Bitly Codes work so well for retailers and service providers across a wide range of industries.

Short links and pages make QR Codes easier to trust and scan

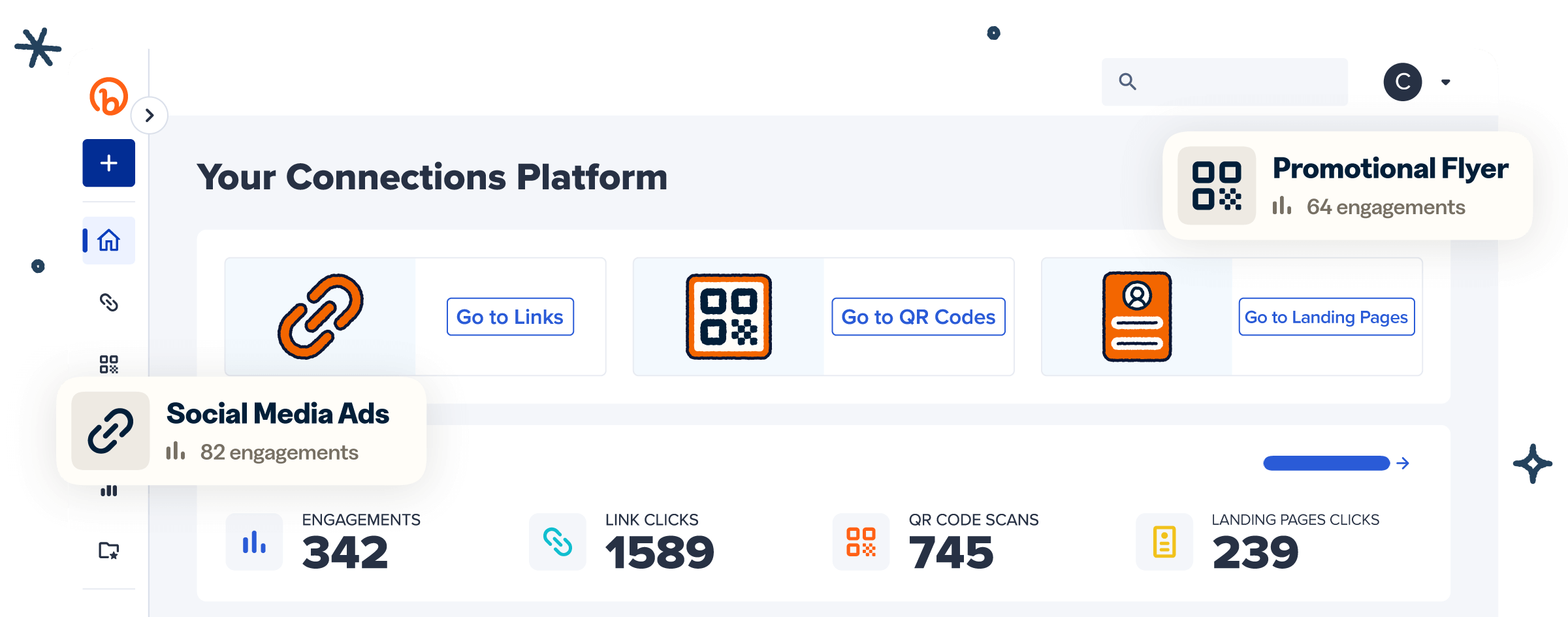

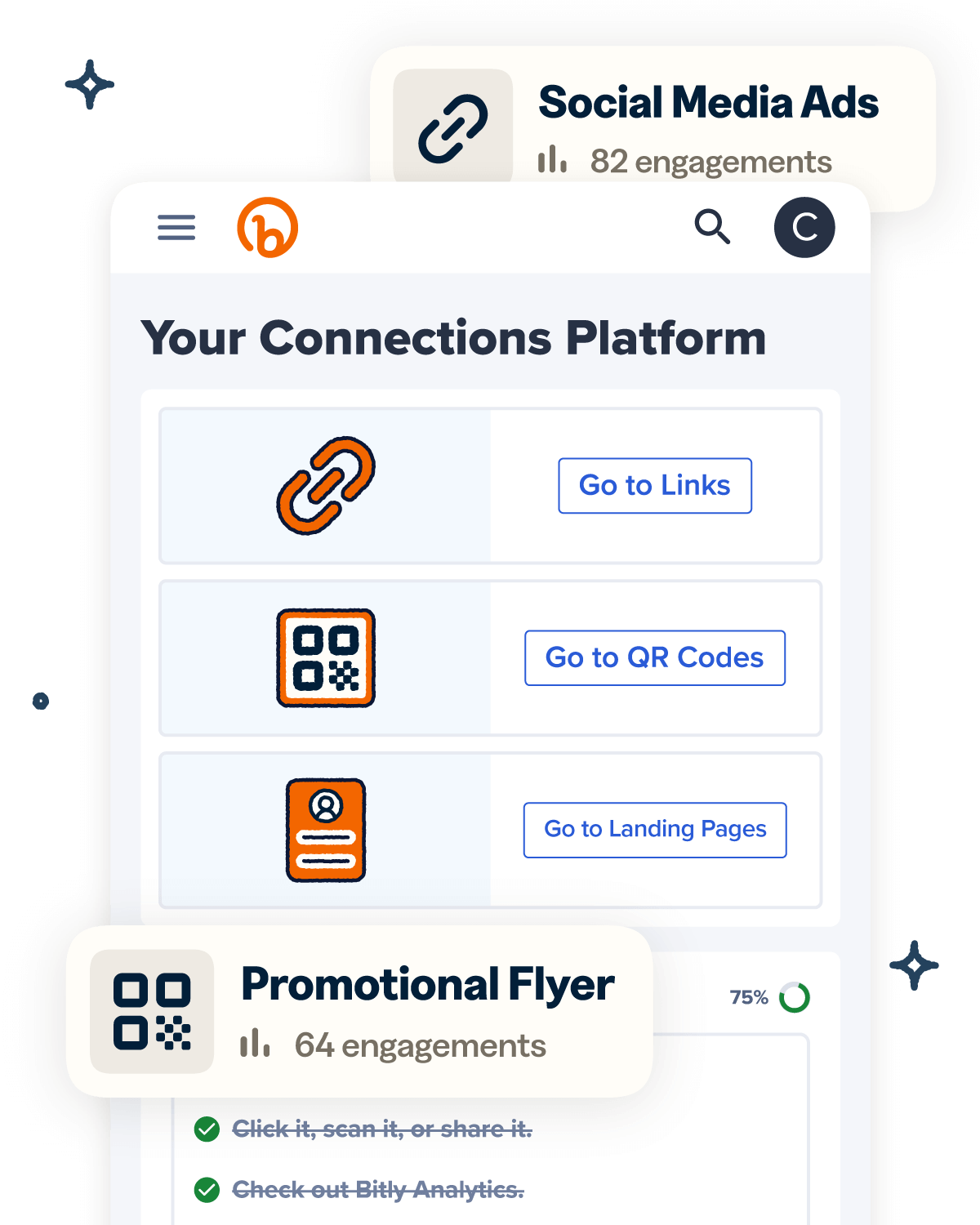

Bitly is more than just a QR Code generator. You can also use the platform to create short links and no-code landing pages, giving sellers a simpler, more polished way to share payment links and business details.

Whenever you create a QR Code, Bitly automatically generates a corresponding short URL that connects to your payment website. Short links look clean, professional, and trustworthy, which is especially important when customers are paying with their smartphones in an offline environment.

With Bitly Pages, you can create a custom landing page for your QR Code—sharing your payment link, plus helpful details about your business like hours, contact info, or promotions. With a variety of templates to choose from, these customizable pages require no coding, work seamlessly on mobile devices, and give customers extra confidence when completing a digital payment.

Dynamic QR Codes offer flexibility and control

All Bitly QR Codes are Dynamic, giving businesses more flexibility and control over their payment processing. When comparing Static vs. Dynamic QR Codes, the difference comes down to adaptability. Static QR Codes are fixed—once printed, their destination URL can’t be changed. For paid Bitly plans, Dynamic Codes let you update the linked page anytime without reprinting materials, depending on the number of redirects allotted per your plan.

This makes it easy to adjust your payment links, switch providers, or direct customers to a new checkout experience, all while using the same printed code.

When creating your code, it’s always smart to add a call-to-action (CTA) alongside it. Simple CTAs like “Scan to pay” or “Make a secure digital payment here” help guide buyers and reinforce trust at checkout.

Wondering how to make a QR Code using Bitly? It’s simple. Just enter your target URL, customize the design to fit your brand, and Bitly will generate your code automatically. From there, you can download it in your preferred format and start using it wherever you accept payments offline.

Scan data gives you visibility after the event

With Bitly Analytics, you can track QR Code scan data to gain valuable insights into customer behavior. It’s a smart way to estimate sales activity in real time, even before payment data officially comes through.

Scan metrics can show you:

- Scans over time

- Total scans

- Location (city/country)

- Referrer

- Device and browser used

Over time, these insights can also support your multi-touch attribution strategy from QR Code scans—helping you understand how offline interactions contribute to your overall customer journey.

While you’ll need an internet connection to view your scan data in Bitly Analytics, you don’t have to be online when the scans happen. Once you’re back online, you can easily review scan activity and use those insights to refine future offline selling strategies.

Power your offline selling moments with Bitly Codes

QR Codes are a smart solution for businesses operating in offline environments without access to Wi-Fi or a standard POS system. They offer a simple, professional way to accept digital payments, even when you’re selling in remote locations or on the go.

With Bitly, every scan becomes a flexible, measurable action. You can customize Bitly Codes to match your brand identity, link to your preferred payment methods, and track valuable scan data once you’re back online. It’s everything small businesses need to create a digital payment experience without relying on complex or expensive hardware.

Use Bitly Codes to power offline purchases for your business—get started today!